Michael Burry’s predictions of the last—and next—stock crash.

Immortalized in a best-selling book and then a Hollywood movie, Michael Burry became a legend as one of the first to predict the subprime mortgage meltdown. He not only predicted it, but used his uncanny aptitude for numerical research to earn hundreds of millions for his hedge fund, Scion Capital.

Some time ago, we published a review of The Big Short movie and the lessons it contains. The movie is well-worth watching—or re-watching—for both its entertainment and educational value. In this article, we revisit why “The Big Short” still matters and what Michael Burry is predicting now.

What is the next threat to the economy, and how big is it?

Based on Michael Lewis’s best-selling book on the 2008 financial crash, The Big Short was a story about “the giant lie at the heart of the economy.” What was the giant lie? The fact that the post-9/11, post-tech-crash recovery was a doomed-to-fail boom cycle fueled by an economic illusion—a huge housing bubble that only a few contrarians could see. As one character in the film asserts matter-of-factly, “No one can see a bubble; that’s what makes it a bubble.”

In 2016, Christian Bale was nominated for an Academy Award for his depiction of Michael Burry in Hollywood’s big screen version of The Big Short. While some of the characters in the movie are fictionalized “composite characters” created for the purpose of the screenplay, Burry was a real player in the true-life drama that unfolded. A relatively inexperienced, brilliant-yet-eccentric hedge fund manager, Burry saw what others couldn’t.

While Wall Street execs and mortgage bankers partied on the profits they raked in with predatory loans that would soon collapse the housing market, then the economy, Burry researched. In between drumming sessions and late-night binges on copious amounts of data, he saw the unmistakable trend. The housing market, mortgage bonds and mortgage-backed securities were headed for an unprecedented collapse. Burry’s convictions led him to battle his own investors over his bold bets with big banks. He spent hundreds of millions shorting mortgage-backed securities, a move so contrarian, it had never been done. Eventually—after large paper losses and no small amount of suspense, the bets paid off.

The prophecies of “Cassandra”—aka, Michael Burry.

The Big Short catapulted Burry into notoriety and made him an investing legend. It also earned him criticism. People who lost their homes or retirement funds asked, “If you knew that the economy could potentially collapse due to the domino of historic mortgage defaults, why didn’t you WARN US!?”

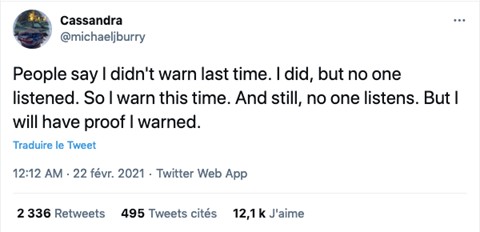

Since then, Michael Burry’s twitter account has been quite forthcoming about his concerns and predictions. He has earned the reputation of a “market bear” because he sometimes predicts crashes that didn’t come (or, just not yet). A line from The Big Short comes to mind, “I may be early, but I’m not wrong.”

Since 2021, Burry’s conviction has grown stronger and his warnings more dire. In early 2021, he changed his Twitter name to “Cassandra” after posting a tweet saying he has warned, but “still, no one listens.”

The name Cassandra is a reference to Greek mythology. A princess of Troy, Cassandra was offered the gift of prophecy—with a twist. When Apollo was rejected by Cassandra, he added a curse to the gift. She must always speak the truth—but her prophecies will never be believed. Cassandra sees a tragic vision of the Trojan horse and warns of the plot, but she is mocked and called names.

A “Cassandra” refers to someone who warns accurately of disasters, yet no one believes them. It is also the name of a software program designed to predict financial crises. (And yes, the program is predicting an imminent recession in the US as well as troubles elsewhere.)

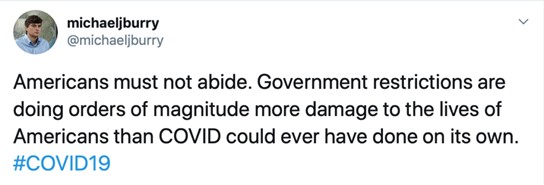

By mid-2020, Burry issued dire warnings that the Covid-related government restrictions would do more damage than the virus. By 2022, even researchers from John Hopkins acknowledged this truth. Covid restrictions were judged to have virtually no effect, while businesses were lost, children fell behind in school, and non-Covid deaths from addictions, suicide and neglected health screenings skyrocketed.

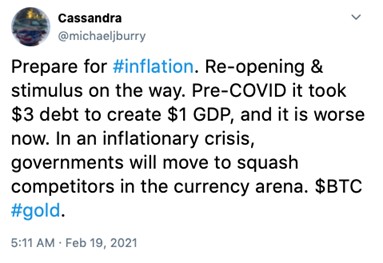

Beginning in early 2021, Michael Burry warned repeatedly about inflation. Unfortunately, Jerome Powell and Janet Yellen were not listening! More and more dollars were pumped into the economy while the economic engineers declared first that there was no inflation, then, that it was “transitory.” Now, our economy is being forced into a recession by repeated interest rate hikes to stop runaway inflation. Of course, the side effect is a knee-capped stock market and job market.

By 2022, headline news was finally echoing the warnings Burry had been posting for months. “Transitory, no. Peak, no. To the moon? If you mean a cold dark place,” Burry said in a since-deleted tweet using the “moon” language of meme-stock and crypto fans. (Burry often deletes his tweets, although the “Burry Archive” account captures them.)

Not all of Michael Burry’s predictions concern pending disasters. He was actually the first (perhaps only?) well-known investor to invest in GameStop before it became a meme-stock favorite. Recognizing it as undervalued and going long, Burry made a cool $270 million on GameStop by “being early.” He sold his position before the stand-off between retail investors and hedge fund short-sellers drove the share price to absurd highs.

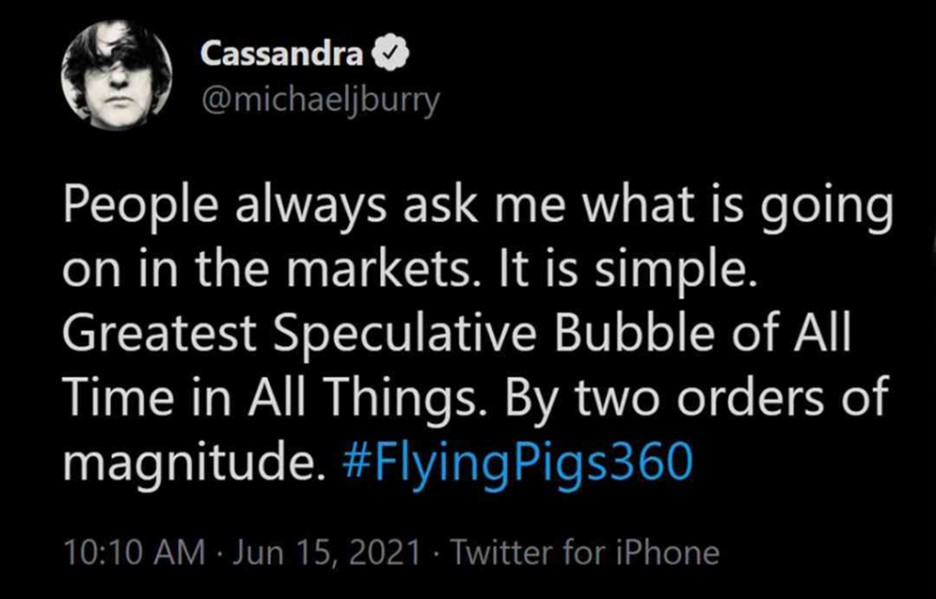

Michael Burry warns of the “mother of all crashes.”

For years, Michael Burry has cautioned that a bubble was forming in index and passive investing funds. Over time, his warnings have grown more urgent and his conviction has increased.

In September of 2022, Burry posted many tweets reminding investors of the history of “bear market rallies” that convince stock market bulls to keep investing. He went through market history to show that 5 to 10 percent gains or more are COMMON… even in the middle of a larger crash.

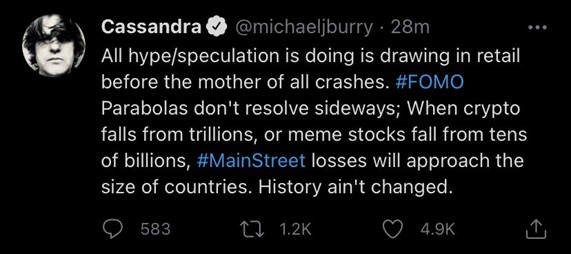

After Burry posted this, “mother of all crashes” #MOAC started to trend:

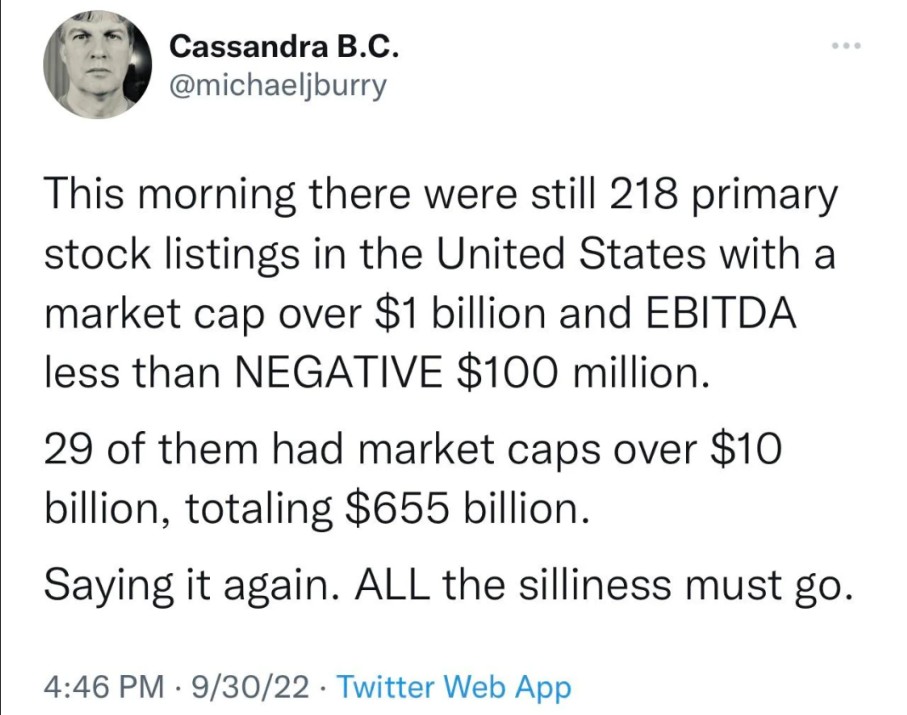

Burry has also been posting about the increased instability in bond markets. About surging consumer debt and credit balances. About the alarming decline in the US savings rate—the lowest rate since just before the 2008 crisis. About supply chain woes that are far from over. About the “silliness” of dramatically over-valued companies:

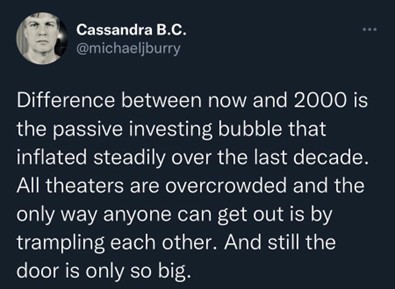

In this Tweet, Michael Burry reminds investors what can happen in a crash when investors start panicking and selling. You can only SELL when there is a BUYER on the other end, which can cause markets to fall violently in mere minutes.

To demonstrate his conviction, the latest regulatory filings of Scion Capital (Burry’s fund) show that he liquidated all but one of his stock holdings. Google (Alphabet), Facebook (Meta), Bristol-Meyers Squibb and eight other positions, all sold, in their entirely.

Is Michael Burry right about an imminent stock market crash?

We don’t know… we traded in our crystal balls for calculators a long time ago!

What we DO know is that risk is increasing risk in the stock market. What we CAN say is that when the financial media starts to acknowledge a recession, things are likely to get worse. We CAN measure past market crashes and we CAN state that a stock market crash of (more or less) 50 percent happens every decade or so.

Oh—and we WILL point out that, if a stock or a market has fallen, say 25% already of a 50% crash, the next leg down would be a 33% reduction from the current level.

100 -25 = 75, a 25% reduction

75 -25 = 50, a 33.3% decrease from 75.

(Open up a simple calculator and enter 75 x .67 to demonstrate this for yourself.)

So it all comes down to the question Clint Eastwood asked in Dirty Harry:

“Do you feel lucky?”

Michael Burry has exited the stock market. How much of your portfolio is still there?

Do you feel lucky enough to gamble your future on being right? Do you feel smarter than one of the most respected investors of the last 20 years? Do you feel lucky enough—and so assured in your convictions—to prefer guesswork to guarantees?

The truth is, we don’t know when the next massive stock market crash will happen. Burry is suggesting it has already started. Maybe Michael Burry is wrong—or he could just be early. (Again.) Maybe Jerome Powell reverses course tomorrow and lowers interest rates, sending stocks soaring.

Either way… we have a suggestion.

Protect against losses while still capitalizing on gains.

The problem is thinking that the stock market is the only way to invest. It is not!

In our opinion, you should NEVER put the majority of your portfolio into an asset class that is volatile, unpredictable and subject to large losses. (You might not want ANY of your dollars in that environment. That’s up to you and your appetite for risk.)

If you have money in a 401(k), IRA, brokerage or bank account and want protection for your principle without having to settle for 1 or 2% gains, we have options.

Whether you want a steady income stream or you’d like to simply protect against losses while having exposure to potential stock market gains, we can help.

Reach out to us at scottmcrae246@gmail.com. Let’s have a short chat to see if we can offer you some solutions.

Don’t get caught at the exit in a crowded theater. Whether your money is inside or outside of a retirement account, chances are, there is something you can do protect your principle while still taking advantage of gains.

Reach out to schedule your no-cost, no-obligation consultation today. scottmcrae246@gmail.com

And don’t forget to put The Big Short on your movie night list! It’s a wildly entertaining film about how Wall Street excesses crashed the economy not all that long ago… plus a brilliant character study of an intriguing modern-day contrarian who should not be ignored.